Over the years, investment professionals have analysed and carefully scrutinised the affects of asset allocation and diversification. It is now widely accepted that this is the main factor that leads to controlled investment growth and limiting losses.

Careful planning and spreading an investment portfolios assets across a selection of asset classes and geographical locations allows us to expose you to more assets that may have long-term growth, whilst reducing potential losses through limiting over-exposure to any specific asset class or geographical region.

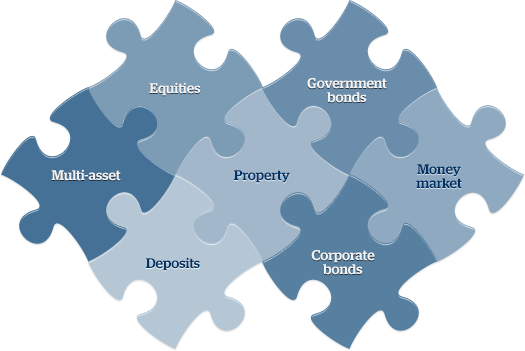

The main asset classes that portfolios hold are as follows:

Equities – Investing in companies offers a higher risk, but with greater potential returns.

Corporate Bonds & Government Bonds – Investing in assets that provide a steady income or capital growth, with a lower risk, but a lower potential for returns than equities.

Property – Investing in property (typically commercial property) can generate income and capital growth, which moves independently from the equities markets.

Multi Asset – These funds invest in a range of assets that offer an already diversified blend of assets.

Convertibles – These are assets that are primarily similar to bonds, but are hybrid securities that can be used to further diversify your portfolio.

Deposit & Money Market – These investments allow you to invest in cash or assets that are tantamount to cash and can be realised at a moments notice. These are typically the lowest risk asset in any portfolio and are frequently used to balance the risk.

By spreading your assets over many differing asset types, the risk of all of your monies decreasing in value is greatly reduced. Although the odds of growth can be reduced, as a result of the exposure to more investment markets, typically it is reduced by a smaller factor and over the longer term is likely to lead to higher growth.

By spreading your assets over many differing asset types, the risk of all of your monies decreasing in value is greatly reduced. Although the odds of growth can be reduced, as a result of the exposure to more investment markets, typically it is reduced by a smaller factor and over the longer term is likely to lead to higher growth.

At Connect Financial Services we have experienced advisers that have been using asset allocation techniques over the years and together we utilise systems to create portfolios for our clients, based on their objectives and their Attitude to Risk profile.